Services

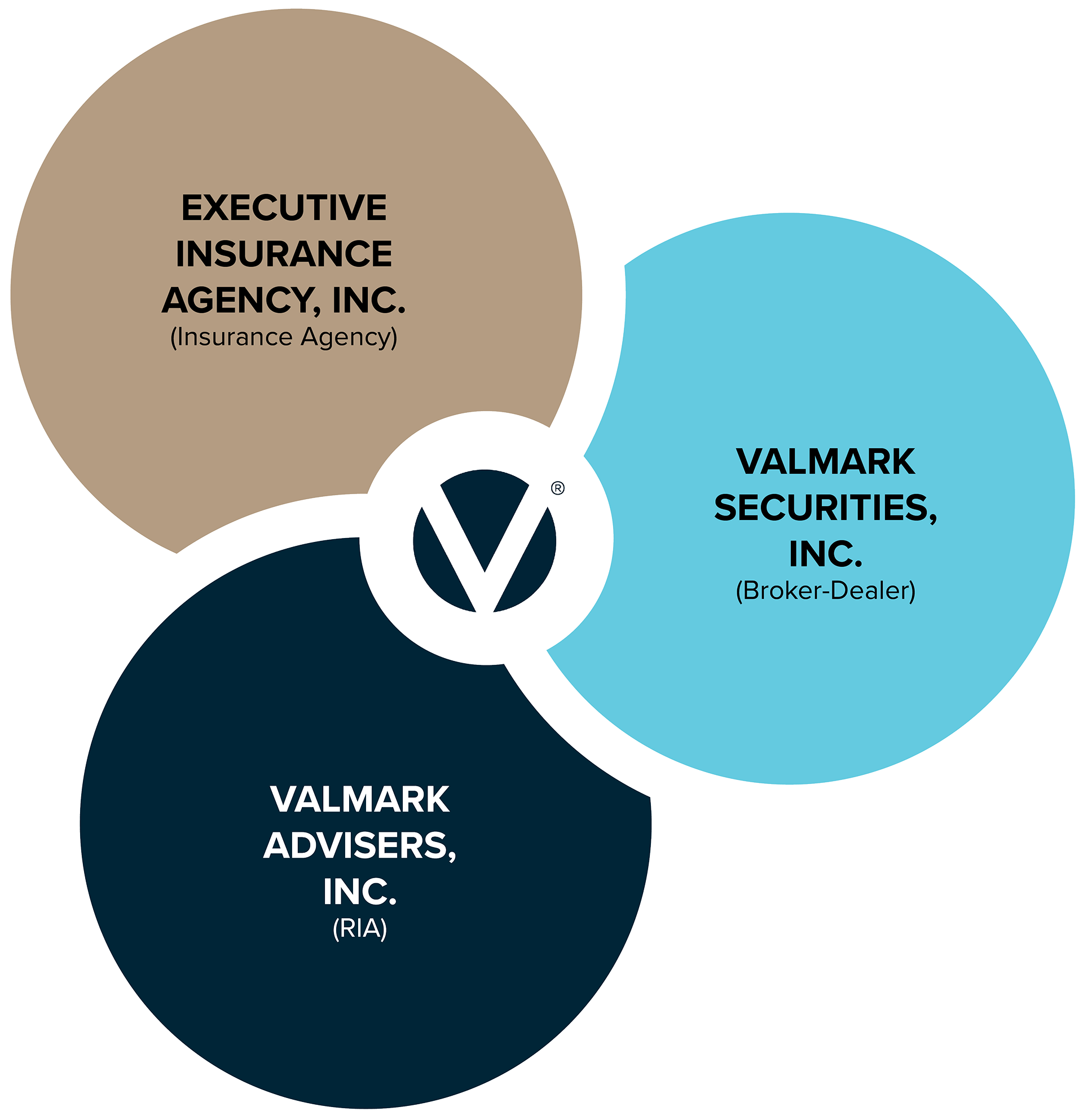

Integrating Three Circles

of Financial Solutions on One Platform

“Valmark is the pre-eminent broker dealer for hybrid firms (multi-disciplinary, selling life insurance AND investment products). Other firms may say they service both sides of your business, but they usually are very inadequate in one or the other. Valmark services life insurance as well as ANYONE in the industry, and they have robust capabilities on the investment side, plus they offer TOPS®, which really rounds out the offering.“

FDP Wealth Management

Member since 2011

Valmark Financial Group® is comprised of 4 entities. Click on each one below to learn more.

- VALMARK FINANCIAL GROUP®

- Executive Insurance Agency, Inc.

- Valmark Advisers, Inc.

- Valmark Policy Management Company, LLC

- Valmark Securities, Inc.

Executive Insurance Agency is an independent, full-service life insurance agency and producer group providing general account, estate planning and business insurance products and services designed for independent wealth transfer professionals. The agency offers:

- A full range of life insurance products as well as disability and long-term care offerings from 25+ industry leading insurance carriers;

- One of the industry’s largest, independent insurance-buying cooperatives for Member Firms with an estimated $60+ billion of in-force life insurance and $8 billion of cash value. This combined buying power gives Members preferred access and leverage to negotiate the best arrangements on behalf of their clients.

- An in-house Concierge Services team which helps take the burden of the life insurance application process off Member Firms so that they can lower their fixed overhead and amount of paperwork and instead focus on building relationships with their clients and revenue generating activities;

- An in-house underwriting facility with a capability greater than most insurance companies, including multi-carrier underwriting expertise for jumbo cases and an Advocacy program designed to eliminate surprises and secure the most favorable offers in the marketplace.

- Fee-based financial planning and consulting;

- Exclusive access to The Optimized Portfolio System (TOPS®), the industry’s first all-Exchange Traded Fund (ETF) investment platform. With $5 billion of assets under management, TOPS® is one of the largest ETF managers in the world. For more information on our TOPS® program, go to www.topsfunds.com;

- Access to a number of industry-leading portfolio management solutions;

- A multi-custodial platform, including Schwab, TD Ameritrade and Pershing.

- Full brokerage services in mutual funds, stocks, bonds and CDs;

- A diversified, open-architecture product line including mutual funds, variable and traditional annuity products, unit investment trusts and managed accounts;

- A retail trading desk offering government securities, municipal bonds, and other fixed income securities through Pershing;

- The broadest set of variable life, variable annuities and COLI products in the industry, including one of the largest blocks of in-force variable life;

- A fully-transparent life settlement brokerage that offers one of the industry’s most efficient and compliant outlets for selling life insurance policies. Our Life Settlements Advocacy program has created an additional $110 million of value for clients.

ValmarkFG®

The Valmark Financial Group Family of Companies

Each of these companies brings a package of solutions, services and products that allow Members to better serve their clients.

A Personal Relationship Means “You First”

The relationship your firm enjoys as a Valmark Member is tailored to YOUR strengths, YOUR goals, and YOUR business. Our flexibility is how you know we respect your expertise.

While many broker dealers may offer a wide range of products and services, their idea of “value added” often means giving you a list of “800 numbers”. At Valmark, you receive a dedicated team of internal professionals who provide integrated support for both your insurance and investment business through a central source. With one phone call, your internal team can coordinate all aspects of your case or inquiry – including technical and marketing support, case design, provider questions, software and online support, underwriting, compliance, client service and more.

HIGH TOUCH MEANS HIGH RETENTION

What is also indicative of the high value we place on our relationships with our Members is our turnover rate of only 1%, which is one tenth of that experienced by other independent broker-dealers.

Today, our average Member Firm generates approximately five times the total revenue that they did two decades ago. This is a strong testament to the sound and collaborative relationships we have built with our Firms, the continued alignment we have with our Members and their clients, and our steadfast commitment to staying flexible and ahead of changes taking place in our industry.

Securities offered through Valmark Securities, Inc. Member FINRA/SIPC. Investment advisory services offered through Valmark Advisers, Inc., a SEC Registered Investment Advisor.

130 Springside Drive, Akron, Ohio 44333. (800) 765-5201. FINRA | SEC | SIPC |MSRB | ©2024 Valmark Financial Group | All rights reserved.