Learn more by watching this two-minute video

Your Best Interests Are

At The Heart Of All We Do

Your Best Interests Are At The Heart Of All We Do

We are an independent life settlement broker providing objective guidance, resources, and a competitive auction process to help you obtain competitive market value for a life insurance policy you no longer need or want.

By connecting you to our network of the majority of leading life settlement providers, we help mitigate the risk of a single provider making a low offer for your policy.

After utilizing our services, you will be come away with a good understanding of the value for both your policy and the options to consider going forward.

How We Help You Obtain Favorable Pricing Is What Sets Us Apart.

How We Help You Obtain Favorable Pricing Is What Sets Us Apart.

Our Competitive Advantage

Marketplace Exposure

Valmark is a leading, national independent broker with strong relationships with the majority of life settlement providers. We favorably position and market your policy to multiple buyers, launch a formal auction, and negotiate offers to obtain competitive market value.

READ MORE

This exposure to the broader life settlement market helps mitigate the risk of a single provider making a low offer for your policy.

Competitive Auction Process

Our Competitive Auction Process is designed to create competition that drives providers to pay top dollar for your policy.

READ MORE

We have historical insight into pricing and managing offers and have developed software that automatically sends providers notifications to encourage them to stay active in the bidding process. This helps drive up the price until the top dollar is achieved. In the example below you can see the value of an auction in action.

Upfront Policy Evaluation

Our 60 years of life insurance industry experience and internal pricing software help us estimate the value of your policy upfront. We provide a thorough policy evaluation within 2-3 days.

READ MORE

By giving you clear expectations in advance, you can make a smart decision about whether to keep or sell your policy. Plus, it enables us to know when a provider is offering a fair price.

Held To A Higher Standard

Valmark treats life settlements as a security under the supervision of the Securities & Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA).

READ MORE

We are held to a higher standard when it comes to ensuring that life expectancy reports, policy information, and other reporting are professionally gathered and assessed to help you receive top dollar for your policy.

A Team of Professionals Working On Your Behalf

You have the assurance that a team of experienced professionals is working behind the scenes on your behalf to efficiently execute the myriad of steps required in a life settlement.

READ MORE

Valmark has combined our 60 years of experience in the life insurance business with a proven life settlement advocacy process to create over $200 million of additional value for our clients over the past 18 years.

One Simple Rule Guides All We Do

Starting with Valmark’s Founder, Lawrence S. Rybka in 1963, the Golden Rule has been a guiding principle in all our practices.

READ MORE

This rule guides all we do, including:

- Serving as an industry model for relationships built on trust and mutual respect

- Addressing the financial needs of our clients with innovative, collaborative solutions

- Safeguarding clients’ best interests at all times

Success Stories

When Premiums Become Unaffordable

Janine1, age 74, received a notice from her insurance company that her policy was a month away from lapsing and her premium would increase by over five times to keep the policy going. She planned to let the policy lapse because she couldn’t afford the higher premium.

READ MORE

- $2,000,000 Universal Life

- Original Premium: $6,321 / yr.

- New Premium: $33,591 / yr. to age 100

- Cash Surrender Value: $0

- Initial offers ranged from $200,000—$250,000

- 16-round competitive auction resulted in a high offer of $511,001 2

When Liquidity Is Needed for Trust-Owned Policies

Helen1, age 90, owned a substantial insurance portfolio held in an irrevocable trust to cover estate taxes. The trust was running out of liquidity to fund all the policies. Selling one policy helped her create liquidity to keep the other policies.

READ MORE

- $4,000,000 Guaranteed Universal Life

- Original Premium: $30,000 / yr.

- New Premium: $311,945 / yr. to age 100

- Cash Surrender Value: $0

- Initial offers ranged from $800,000—$1,100,000

- 4-round competitive auction resulted in a high offer of $1,390,000 2

When Business-Owned Insurance Is No Longer Needed

Jack1, age 62, had a key-man insurance policy that his employer paid for. Upon retiring, Jack was able to keep the policy but also had to pay the premium. He wasn’t interested in paying for the policy, so he

planned to surrender it.

READ MORE

- $7,200,000 Universal Life

- Original Premium: $72,000 / yr.

- New Premium: $168,948 / yr. to age 100

- Cash Surrender Value: $12,068

- Initial offers ranged from $50,000—$100,000

- 24-round competitive auction resulted in a high offer of $437,430 2

When Healthy Insureds Want to Sell Their Policy

Grace1, age 81, had two children who were grown and established, and her estate taxes were no longer a concern. She felt she didn’t really need her insurance policy and the premiums were a drag on her retirement spending.

READ MORE

- $2,000,000 Universal Life

- Current Premium: $90,613 / yr.

- Cash Surrender Value: $0

- Life Expectancy: Over 13 years

- Marketed case to specialty buyers for healthy elderly insureds

- Competitive auction resulted in a high offer of $210,000 2

When Term Policies are Near Their Term Conversion Deadline

Akira1, age 64, originally purchased a term policy to provide liquidity for his business and estate. He felt the level term premium was affordable but converting it to a permanent policy was too expensive. Akira was able to sell his policy prior to the conversion deadline for a substantial value.

READ MORE

- $5,000,000 Term Life

- Original Term Premium: $7,925 / yr.

- New Conversion Premium: $164,778 / yr. to age 100

- Akira split the policy into two policies: one $3.5M and one $1.5M

- After a 13-round auction, the $3.5M term policy sold for $1,081,000 2

- The $1.5M term policy was converted and kept for Akira’s family

When a Policy Is No Longer Needed For Estate Planning

Evelyn1, age 97, had an estate that was highly liquid and no longer needed a policy for estate planning. The beneficiaries wanted to stop paying premiums and recoup $7M already paid into the policy.

READ MORE

- $15,000,000 Universal Life

- Current Premium: $900,000 / yr.

- Cash Surrender Value: $0

- Life Expectancy: 4 to 4.5 years

- Competitive auction resulted in a high offer of $8,500,000 2

- Enabled Emily’s family to recover the premiums paid into the policy while creating significant cash flow for the family to use for other immediate needs.

Our Time-Tested Tools And Procedures Help Make The Process Easier For You.

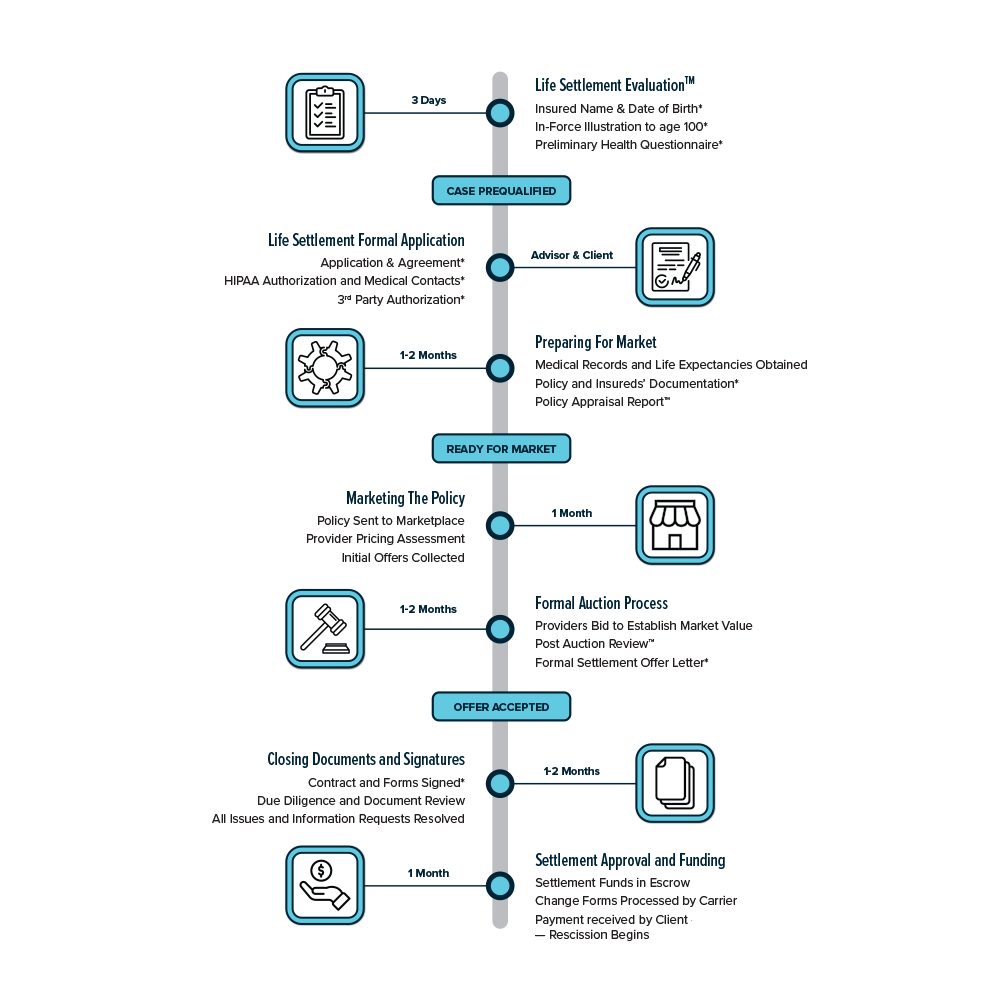

Our goal is to not only help you obtain the highest fair market value for your policy, but to also make the process as simple as possible. This timeline is one of dozens of helpful tools that we have created for you and your Valmark Advisor.

Our Time-Tested Tools And Procedures Help Make The Process Easier For You.

Our goal is to not only help you obtain the highest fair market value for your policy, but to also make the process as simple as possible. This timeline is one of dozens of helpful tools that we have created for you and your Valmark Advisor.

We Are A Professional Resource For Advisors

We are an independent and confidential resource for legal, accounting, trust, and other advisors to address their clients’ Life Settlement needs. Services can be provided behind the scenes through your firm or via direct client interface—on a case-by-case basis.

Watch our video on how we work with professional advisors

“In the 15 years we’ve been working with Life Settlements, we have created over $200 million of proceeds for clients.“

President

Valmark Financial Group

Meet Our Life Settlements Team

Our team is made up of skilled and experienced professionals from a variety of financial disciplines working together to provide a seamless process for helping you obtain the highest fair market value for your policy.

Our team includes: 3 internal underwriters, 6 life settlement analysts, dedicated compliance oversight, experienced legal counsel, and credentialed specialists, including CFP®, CLU®, ChFC®, JD, LL.M. (Tax), MBA, FINRA Series 7, 24, 66, Life & Health Insurance licenses, and other financial professional designations.

James Dawson, CFP®, CLU®

Director of Life Settlements,

Valmark Financial Group

Michael Michlitsch, MBA, CRPC®

Vice President of Inforce Insurance Solutions,

Valmark Financial Group

Caleb J. Callahan, CFP®

President and Chief Operating Officer, Valmark Financial Group

Larry J. Rybka, JD, CFP®

Chairman and CEO,

Valmark Financial Group

Chris Bottaro, MBA

Senior Vice President, Insurance,

Valmark Financial Group

Doug Wilburn

General Counsel and Chief Compliance Officer,

Valmark Financial Group

Neil Petkovic

Senior Legal Counsel,

Valmark Financial Group

Weston Latham

Associate Analyst,

Life Settlements,

Valmark Financial Group

Eric Johnson

Vice President,

Underwriting,

Valmark Financial Group

Michael Amoia, JD, LL.M. (TAX), CLU®, ChFC®

Vice President,

Advanced Markets,

Valmark Financial Group

Eric Johnson

Vice President,

Underwriting,

Valmark Financial Group

Michael Amoia, JD, LL.M. (TAX), CLU®, ChFC®

Vice President,

Advanced Markets,

Valmark Financial Group

Bring The Golden Rule To Life

Ready To Get Started?

Valmark has offices throughout the US. Contact us directly if you have a potential life settlement opportunity that you would like to discuss.

Please send us a message below and we will get back to you as soon as possible

Ready To Get Started?

Valmark has offices throughout the US. Contact us directly if you have a potential life settlement opportunity that you would like to discuss.

Please send us a message below and we will get back to you as soon as possible

Contact Us

Do you have a potential life settlement situation that you would like to discuss? We would love to have a conversation with you.

Please send us a message below and we will get back to you as soon as possible.

In a life settlement agreement, the current life insurance policy owner transfers the ownership and beneficiary designations to a third party, who receives the death proceeds at the passing of the insured. As a result, this buyer has a financial interest in the seller’s death.

A policy owner should consider the continued need for coverage, and, if the policy owner plans to replace the existing policy with another policy, the policy owner should consider the availability, adequacy, and cost of comparable coverage.

Policy owners considering the need for cash should consider other less costly alternatives to a life settlement.

When an individual decides to sell their policy, they must provide complete access to their medical history, and other personal information, that may affect their life expectancy. This information is requested during the initial application for a life settlement.

After the completion of the sale, there may be an ongoing obligation to disclose similar and additional information to the buyer or servicing agent at a subsequent date.

A life settlement may affect the insured’s ability to obtain insurance in the future and the seller’s eligibility for certain public assistance programs, such as Medicaid, and there may be tax consequences.

Individuals should discuss the taxation of the proceeds received from a life settlement with their tax advisor.

A life settlement transaction may require an extended period of time to complete. Due to complexity of the transaction, fees and costs incurred with the life settlement transaction may be substantially higher than other securities.

Once the policy is transferred, the policy owner has no control over subsequent transfers.

Valmark and its registered representatives act as brokers on the transaction and may receive a fee from the purchaser.

Securities offered through Valmark Securities, Inc. Member FINRA/SIPC. Investment advisory services offered through Valmark Advisers, Inc., a SEC Registered Investment Advisor.

130 Springside Drive, Akron, Ohio 44333. (800) 765-5201. FINRA | SEC | SIPC |MSRB | ©2024 Valmark Financial Group | All rights reserved.